Welcome, entrepreneurs and visionaries! You've got the groundbreaking idea, the passion, and the drive. But before you change the world, you have to make a foundational decision that will shape your company's future: where to incorporate. It's a choice that goes far beyond just picking a spot on a map. The state you choose becomes your company's legal home, influencing everything from your tax burden and liability exposure to your ability to attract investors.

This isn't just paperwork; it's a strategic move that can either create a smooth runway for growth or set up future legal and financial hurdles. With 50 states offering different rules, costs, and benefits, the options can feel overwhelming. Many founders wonder if incorporating in their home state is enough or if choosing a business-friendly state like Delaware or Wyoming is a better long-term play. The answer depends entirely on your specific goals. Are you aiming to go public and need the gold standard of corporate law? Or are you a startup focused on privacy and keeping costs low?

In this guide, we'll demystify the process and help you find the best states to incorporate based on your unique needs. We'll break down the top contenders, going beyond the obvious to give you the practical insights needed to choose wisely. While making this decision, it's also crucial to consider your business structure, as there are significant that can complement your choice of state. Think of this as your strategic blueprint to finding the perfect legal foundation for your business, ensuring you start your journey on the strongest possible footing.

1. Delaware: The Gold Standard for Ambitious Companies

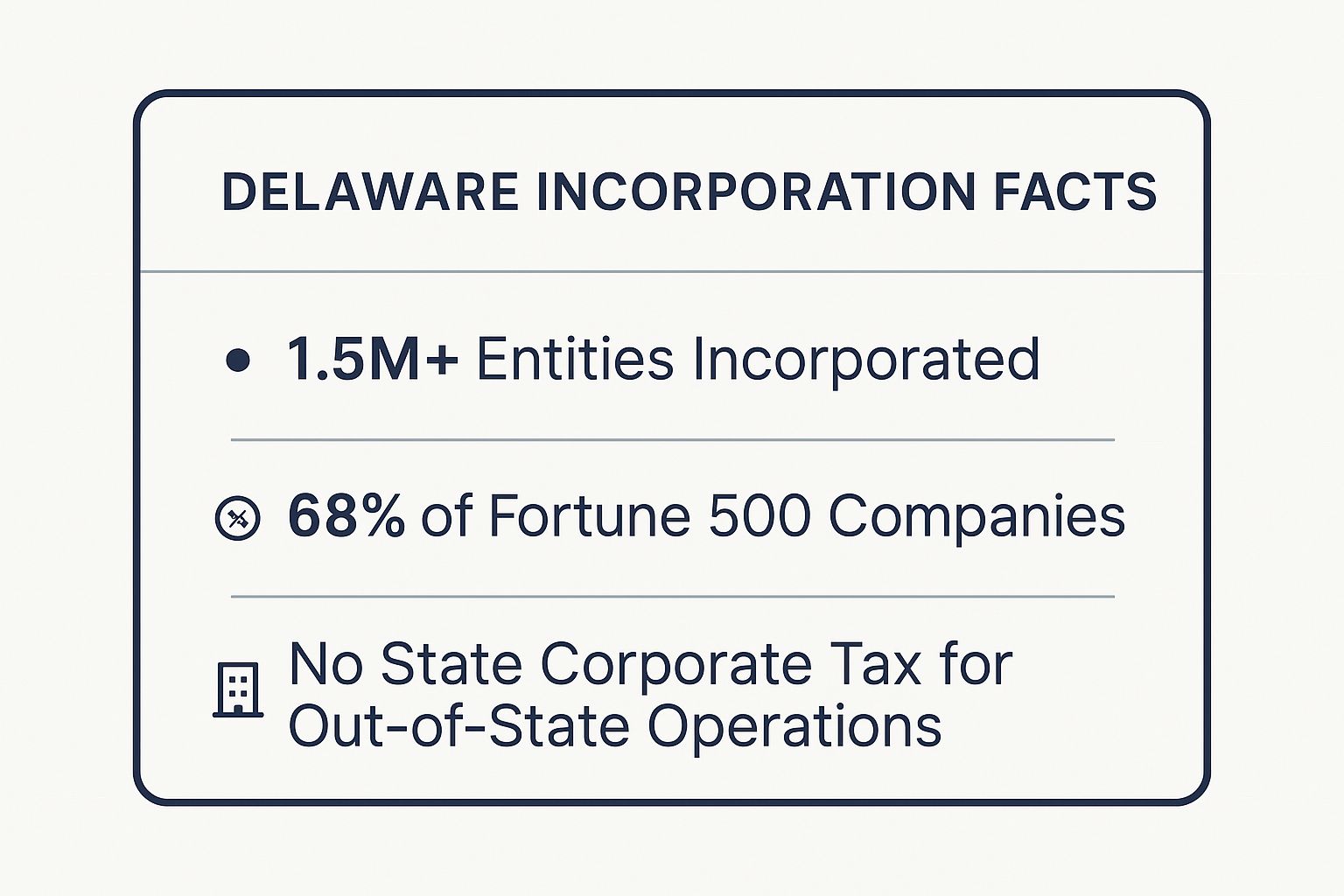

When you hear seasoned entrepreneurs, venture capitalists, or corporate lawyers discuss the best states to incorporate, one name consistently tops the list: Delaware. It’s not just a popular choice; it’s an institution. 91�Թ��� to over 1.5 million legal entities, including a jaw-dropping 68% of Fortune 500 companies, Delaware's reputation is built on a foundation of unparalleled corporate legal infrastructure.

The state’s primary advantage is its highly developed body of corporate law, the Delaware General Corporation Law (DGCL). This isn't just a static rulebook; it's a dynamic, flexible, and predictable framework that business leaders and investors trust. This trust is supercharged by Delaware's secret weapon: the Court of Chancery. This specialized business court is presided over by expert judges who only handle corporate disputes. This means you get swift, sophisticated rulings based on centuries of established case law, providing a level of predictability you just can't find anywhere else.

Why Delaware Attracts Ambitious Founders

The "Delaware advantage" truly shines when a company has big growth plans, particularly those involving outside investment or a future public offering. Investors, from angel investors to massive venture capital firms in Silicon Valley, are deeply familiar and comfortable with Delaware law. They understand the rights of shareholders, the duties of directors, and the processes for mergers and acquisitions under the DGCL.

Choosing Delaware signals to investors that you're serious about corporate governance and are building a company designed for scale. This is why titans like Apple, Amazon, and Google (Alphabet) are incorporated there, despite having headquarters elsewhere.

This quick reference highlights a few of Delaware's most impressive corporate statistics.

These numbers underscore why Delaware isn't just a choice but the default for companies with high-growth potential that need a stable, investor-friendly legal home.

Actionable Tips for Delaware Incorporation

If Delaware sounds like the right fit for your venture, keep these practical steps in mind:

- Plan for Venture Capital: If raising funds from VCs is on your roadmap, incorporating in Delaware from the start can save you a complex and expensive re-incorporation process later.

- Budget for Franchise Tax: While Delaware doesn't tax corporate income for businesses operating outside its borders, it does levy an annual franchise tax. The minimum is $175 for corporations, but it can increase based on your company's shares and assets.

- Hire a Registered Agent: Since you likely won't have a physical office in Delaware, you are required to hire a registered agent service. This service receives official legal and tax documents on your behalf, ensuring you stay compliant.

- Maintain Corporate Formalities: To benefit from Delaware's strong liability protections, you must maintain proper corporate records. This includes holding regular board meetings, keeping minutes, and maintaining a clear separation between personal and business assets.

2. Nevada: The Privacy and Asset Protection Haven

While Delaware holds the crown for venture-backed giants, Nevada has carved out a powerful niche as the "Delaware of the West," appealing to entrepreneurs who prioritize privacy, asset protection, and tax efficiency. The state has intentionally crafted a pro-business environment that draws in thousands of new entities each year, from small online businesses to complex holding companies.

Nevada's allure is built on a few key pillars: no state corporate income tax, no personal income tax, and minimal reporting and disclosure requirements. This combination makes it a sanctuary for business owners who want to keep their financial affairs and ownership details private. The state's statutes are designed to provide some of the strongest liability protections in the country, shielding owners' personal assets from business debts and lawsuits with what is often called the "Nevada corporate veil."

Why Nevada Appeals to Privacy-Conscious Owners

Nevada's primary advantage is its emphasis on confidentiality. The state does not require a public listing of corporate shareholders, allowing owners to maintain a high degree of anonymity. This is a significant draw for entrepreneurs who may not want their personal assets or involvement in a company to be public knowledge. For businesses prioritizing privacy, it's crucial to grasp the full scope of data protection; you can explore additional resources on .

This focus on privacy and asset protection makes Nevada an ideal choice for specific business structures. It is a popular domicile for holding companies that own assets like real estate or intellectual property, as well as for online businesses and international entrepreneurs who value discretion. By separating assets into a Nevada entity, owners can create a powerful shield against legal and financial threats.

Actionable Tips for Nevada Incorporation

If Nevada’s unique benefits align with your business goals, consider these practical steps:

- Prioritize Privacy and Asset Protection: Choose Nevada if your primary goals are to shield personal assets from business liabilities and maintain shareholder anonymity. It is less suited for companies planning to seek venture capital, as investors typically prefer Delaware's familiar legal structure.

- Establish a Genuine Business Presence: To fully leverage Nevada's tax and liability benefits, it's wise to establish a genuine connection to the state, such as a bank account or office. This helps defend against legal challenges that might claim your company is a "shelf corporation" simply avoiding taxes in your home state.

- Understand the Annual Requirements: Nevada requires an annual filing of a list of officers and directors, which does become public record. Plan for this disclosure and the associated annual fees to remain in good standing.

- Consult with a Specialist: Nevada's laws, particularly around asset protection and charging orders for LLCs, are robust but complex. Working with a Nevada-qualified attorney or tax advisor is crucial to ensure your corporate structure is set up correctly to provide maximum protection.

3. Wyoming: The Entrepreneur’s Haven for Privacy and Affordability

While Delaware is the heavyweight champion for venture-backed giants, Wyoming has carved out a powerful niche as the top contender for small businesses, online entrepreneurs, and anyone prioritizing privacy and low costs. It offers an incredibly business-friendly environment that combines robust liability protection with minimal bureaucratic red tape, making it one of the best states to incorporate for modern, agile companies.

Wyoming's appeal lies in its simplicity and powerful pro-business statutes. It was the first state to create the Limited Liability Company (LLC) in 1977, and it continues to innovate with laws designed to protect business owners. The state famously has no corporate or individual state income tax, which is an immediate and significant advantage for any profitable enterprise. This straightforward, low-cost approach removes financial friction and lets entrepreneurs focus on growth.

Why Wyoming Attracts Modern Entrepreneurs

Wyoming's unique combination of benefits makes it a magnet for specific types of businesses that may not need Delaware's complex corporate court system. Its privacy protections are a major draw; Wyoming allows for "nominee" officers and directors, meaning the actual owners' names are not required to be listed on public records. This is ideal for e-commerce store owners, consultants, and real estate investors who value anonymity.

The state’s low fees are another huge plus. With a modest annual report fee (based on assets located in the state, which is often $0 for online businesses), the ongoing cost of maintaining a Wyoming entity is among the lowest in the nation. This affordability and privacy make it a top choice for real estate holding companies, consulting firms, and international entrepreneurs looking for an accessible entry into the U.S. market without the high costs and public scrutiny of other states.

Actionable Tips for Wyoming Incorporation

If Wyoming's low-cost, high-privacy framework aligns with your business goals, consider these practical steps:

- Prioritize Privacy and Cost: If your primary concerns are keeping operational costs to a minimum and shielding your personal information from public view, Wyoming is likely a better choice than Delaware.

- Maintain a Registered Agent: Like other states, you must have a registered agent with a physical address in Wyoming. This service typically costs between $50 and $150 annually and is essential for compliance.

- Leverage LLC Protections: Wyoming offers some of the strongest LLC protections in the country, including robust charging order protection, which helps shield your personal assets from business liabilities.

- Keep Records Updated: Although Wyoming's reporting requirements are minimal, it's crucial to maintain proper internal records, such as your operating agreement and meeting minutes, to ensure your liability shield remains intact.

4. Texas: The Lone Star State for Business Growth

While Delaware often dominates conversations about incorporation, Texas presents a powerful and increasingly popular alternative, especially for businesses that plan to operate within its borders. The state's appeal isn't just about its famous "no state income tax" policy; it's a comprehensive package of a booming economy, a business-friendly regulatory environment, and significant legal protections. Texas has cultivated an ecosystem where businesses, from massive energy corporations to nimble tech startups, can thrive.

The core advantage for many is the alignment of incorporation with operations. Incorporating where you do business simplifies compliance and administrative tasks significantly. Texas backs this up with the Texas Business Organizations Code (BOC), which provides a clear and modern legal framework for corporate governance. Unlike states with specialized business courts, Texas handles corporate disputes through its established trial court system, which is well-versed in business litigation and offers a robust legal process.

Why Texas Attracts On-the-Ground Entrepreneurs

The "Texas Two-Step" of no personal or corporate state income tax is a massive draw, leaving more capital available for reinvestment and growth. This financial benefit is amplified by the state's diverse and resilient economy, with major hubs for energy, technology, and healthcare. For entrepreneurs looking to build a physical presence, Texas offers access to a vast talent pool and a lower overall cost of doing business compared to coastal hubs.

This practical, pro-growth environment is why corporate giants like ExxonMobil and AT&T have long called Texas home, alongside tech titans such as Dell Technologies and Texas Instruments. The thriving "Silicon Hills" of Austin also demonstrates the state's appeal to the next generation of innovators, making it a premier destination for businesses wanting to plant their roots and grow.

Actionable Tips for Texas Incorporation

If the business-friendly climate of Texas aligns with your goals, consider these practical steps:

- Operate Where You Incorporate: The primary benefit of choosing Texas is for businesses that will have a significant physical presence or conduct most of their operations within the state. This simplifies tax and compliance obligations.

- Understand the Franchise Tax: While Texas has no corporate income tax, it does levy a franchise tax on entities with revenues above a certain threshold. It's crucial to factor this into your financial projections.

- Leverage State Incentive Programs: The Texas Economic Development Corporation offers numerous grants, tax incentives, and programs to attract and support businesses. Research these opportunities to see if your company qualifies.

- Stay on Top of Compliance: Operating a business in Texas requires adherence to state-specific regulations. Following a detailed guide is essential for maintaining good standing and liability protection. Keeping up with your obligations can be simplified by referencing a small business compliance checklist.

5. Florida: The Sunshine State for Business Growth

While Delaware is the titan for high-growth tech and Nevada is known for its privacy, Florida has carved out a powerful niche as a premier destination for businesses focused on growth, international trade, and favorable tax environments. The Sunshine State's appeal is straightforward and compelling: no state corporate or personal income tax, a pro-business regulatory climate, and a booming economy.

Florida's primary advantage is its potent combination of tax benefits and strategic location. The absence of a state income tax is a massive draw for business owners and their employees, making it easier to attract and retain top talent. This tax-friendly approach is bolstered by its geographic position as a gateway to Latin America and the Caribbean, making it a natural hub for international trade, logistics, and finance.

Why Florida Attracts Growth-Minded Entrepreneurs

The "Florida advantage" is particularly strong for companies engaged in import/export, e-commerce, and services targeting international markets. Its world-class ports, airports, and multilingual workforce create a dynamic ecosystem for global commerce. The state's economic development organizations, like Enterprise Florida, actively court new businesses with various incentives and support programs, further sweetening the deal.

Choosing Florida signals a focus on operational efficiency and market access. It’s a practical choice for businesses that want to keep overhead low while tapping into a large, diverse, and growing consumer base. This is why major players like NextEra Energy, AutoNation, and Citrix Systems have thrived there, alongside a rapidly expanding list of fintech, aerospace, and international companies setting up their U.S. headquarters.

Actionable Tips for Florida Incorporation

If Florida's pro-business climate aligns with your goals, here are some key steps to consider:

- Leverage Its Location: If your business involves international trade or logistics, actively build your strategy around Florida's ports and trade infrastructure to maximize efficiency and market reach.

- Explore State Incentives: Research the various tax credits and incentive programs offered by the state and local economic development agencies. These can provide significant capital for qualified businesses in target industries.

- Plan for the Environment: While the business climate is sunny, the actual climate requires planning. Factoring in costs for hurricane insurance and creating a solid disaster preparedness plan is a non-negotiable part of operating in Florida.

- Comply with Filing Requirements: Florida requires corporations to file an annual report by May 1st to remain in good standing. Missing this deadline results in a steep late fee, so mark your calendar and stay compliant from day one. To get started on the right foot, explore a comprehensive small business setup checklist to ensure you cover all your bases.

6. New York: The Hub for Global Finance and Influence

While states like Delaware and Nevada are famous for corporate-friendly laws, New York stands out for a different, powerful reason: proximity to the global epicenter of finance and commerce. Incorporating in New York is a strategic move for businesses that thrive on access to capital markets, top-tier professional services, and a dense network of industry leaders. It's less about tax loopholes and more about planting your flag where the action is.

New York's primary advantage lies in its unparalleled ecosystem. The state is home to the world's most sophisticated legal and financial infrastructures, driven by Wall Street and the presence of the New York Stock Exchange and NASDAQ. This environment has cultivated a body of corporate law and a judicial system that is highly experienced in complex commercial and financial disputes. For companies in finance, international trade, or media, this legal sophistication is a significant asset.

Why New York Attracts Industry Powerhouses

The "New York advantage" is most potent for companies that need to be close to investors, major banking institutions, and a world-class talent pool. While the costs are higher, the benefits of direct access to capital and networking opportunities are often invaluable. This is why many of the world's largest banks, investment firms, and media conglomerates are incorporated and headquartered in New York.

Choosing New York signals a commitment to operating at the highest level of your industry. It places your business in the same legal and physical jurisdiction as giants like JPMorgan Chase, Verizon, and IBM, providing credibility and immediate access to a network that is difficult to replicate anywhere else. This is particularly true for startups in "Silicon Alley" that benefit from the city's vibrant venture capital scene.

Actionable Tips for New York Incorporation

If your business model relies on the unique advantages of the Empire State, consider these practical steps:

- Plan for Higher Costs: New York has higher filing fees, franchise taxes, and overall operating costs compared to other states. Factor these into your financial projections from day one to ensure they align with your budget.

- Leverage the Network: Incorporation is just the first step. Actively participate in industry events, connect with local accelerators, and build relationships within New York's vast professional communities. Your location is a key asset.

- Navigate the Regulatory Landscape: New York has a complex regulatory environment. Staying compliant is crucial, which includes obtaining the correct permits and licenses for your specific industry. To get started, you can learn more about how to get a business license in New York.

- Attract Top Talent: Use your New York base as a recruiting tool. The state is home to some of the world's best universities and attracts ambitious professionals from across the globe. Highlight this access to talent when speaking with investors and partners.

7. Colorado: The Rocky Mountain Hub for Modern Business

While states like Delaware and Nevada dominate conversations about incorporation, Colorado has quietly emerged as a powerful contender, especially for modern, lifestyle-focused businesses. It offers a unique blend of a pro-business environment, a highly educated workforce, and an enviable quality of life, making it one of the best states to incorporate for companies that value innovation and employee well-being.

Colorado's appeal lies in its balanced approach. It boasts a flat corporate income tax rate, which is one of the lowest in the nation, making it financially attractive. This straightforward tax structure, combined with a robust and growing economy, creates a fertile ground for startups and established companies alike. The state government actively supports this growth through various initiatives and programs managed by the Colorado Office of Economic Development and International Trade.

Why Colorado Attracts Innovative Founders

The "Colorado advantage" is most apparent for businesses in the tech, outdoor recreation, and aerospace sectors. The state's vibrant startup ecosystems in cities like Denver and Boulder are magnets for talent and venture capital, fostering a culture of collaboration and forward-thinking. This environment is ideal for founders who want to build a strong company culture centered around work-life balance, attracting top-tier talent who are drawn to the state’s mountains and active lifestyle.

This synergy between business and lifestyle is why major companies like Chipotle Mexican Grill, Ball Corporation, and Arrow Electronics have made Colorado their home. It signals a commitment not just to profit, but to building a sustainable and attractive place to work, which is a powerful tool for employee retention and recruitment in today's competitive market.

Actionable Tips for Colorado Incorporation

If Colorado's innovative and balanced environment aligns with your business vision, consider these practical steps:

- Leverage Local Talent: Tap into the highly educated workforce graduating from institutions like the University of Colorado and Colorado State University. Explore partnerships and recruitment programs to find skilled employees.

- Explore Industry-Specific Incentives: Colorado offers various tax credits and grants for businesses in key sectors like aerospace, renewable energy, and advanced manufacturing. Research what your business might qualify for.

- Connect with the Startup Scene: Immerse yourself in the local entrepreneurial community. Participate in events in Denver and Boulder to network with investors, mentors, and potential partners who can help accelerate your growth.

- Prioritize Company Culture: Use Colorado's lifestyle appeal as a core part of your company's identity. This can be a significant advantage in attracting and retaining employees who are looking for more than just a paycheck.

Top 7 States to Incorporate Comparison

| State | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Delaware | Moderate to High – sophisticated legal framework and registered agent required | Higher costs – franchise tax, registered agent fees | Strong legal protections, investor confidence, IPO readiness | Companies seeking investment, IPOs, complex governance | Premier legal framework, extensive precedents, fast expert courts |

| Nevada | Low to Moderate – minimal reporting, no corporate income tax | Low costs – minimal fees, no income or franchise tax | High privacy, tax savings, asset protection | Privacy-focused businesses, holding companies, tax-savvy entrepreneurs | Excellent privacy, tax advantages, low compliance burden |

| Wyoming | Low – very simple compliance, minimal fees | Very low costs – lowest filing and annual fees | Cost-effective, privacy, fast processing | Small businesses, startups, cost-conscious entrepreneurs | Lowest fees, strong privacy, simple regulation |

| Texas | Moderate – requires registered agent, franchise tax applies | Moderate costs – franchise tax and filing fees | Access to large markets, robust economy, business support | Companies operating in Texas, tech startups | No personal income tax, large economy, strong infrastructure |

| Florida | Moderate – corporate income tax applies, registration required | Moderate costs – state tax lower than many states | Access to Latin American markets, growing tech sectors | International businesses, Latin America market focus | Strategic location, no personal income tax, trade gateway |

| New York | High – complex regulations, high fees and taxes | High costs – state/local taxes, expensive compliance | Access to capital markets, strong legal infrastructure | Financial services, companies needing capital access | Largest financial markets, strong legal precedent |

| Colorado | Moderate – corporate tax applies, foreign registration possible | Moderate costs – corporate tax, incentives available | Skilled workforce, balanced growth, growing startup scene | Tech companies, outdoor industry, lifestyle-focused firms | Competitive taxes, educated workforce, strong startup ecosystem |

Making the Right Choice for Your Company's Future

Navigating the landscape of incorporation can feel like choosing a permanent home for your business. As we've journeyed through the top contenders, from the corporate law powerhouse of Delaware to the privacy-centric frontier of Wyoming, one truth becomes crystal clear: there is no universal "best state to incorporate" for every single business. The ideal choice is deeply personal and hinges on your unique vision, operational model, and long-term ambitions.

This decision is a strategic cornerstone, not just a piece of administrative paperwork. It sets the stage for everything that follows, including how you attract investment, protect your personal assets, manage your tax obligations, and maintain your privacy. Getting this right from the start saves you from costly and complex restructuring down the road.

Recapping the Key Players

Let's quickly revisit the core strengths we've discussed. Your decision should be an intentional one, weighing these distinct advantages against your specific needs:

- Delaware: The gold standard for venture-backed startups and companies with IPO aspirations. Its Chancery Court and established corporate law provide unparalleled predictability and legal protection, making it the top choice for investors.

- Nevada: A strong contender for businesses prioritizing privacy and no state-level income tax. While its reputation has shifted, it remains a powerful option for owners who want to shield their personal information from public records.

- Wyoming: The pioneer of the LLC and a haven for privacy and asset protection at a very low cost. It offers many of Nevada's benefits but with lower fees and a more modern, founder-friendly approach.

- Texas & Florida: Economic powerhouses offering the significant advantage of no state income tax. These are often the best states to incorporate if your primary operations and customer base are located within their borders, simplifying your compliance and tax strategy.

- New York & Colorado: Vibrant hubs for specific industries. New York offers global prestige, especially for finance and media, while Colorado provides a supportive, eco-conscious environment for innovative startups and socially-minded businesses.

Your Action Plan: Moving from Information to Decision

So, where do you go from here? The information in this guide is your map, but you still need to plot your specific course. Don't let analysis paralysis set in. Instead, channel this knowledge into a structured decision-making process.

- Define Your Five-Year Vision: Where do you see your company in five years? Will you be seeking venture capital? Do you plan to operate entirely online? Will you have physical locations in multiple states? Your future goals are the most important factor in this decision.

- Conduct a Cost-Benefit Analysis: Create a simple spreadsheet. In one column, list your top two or three state choices. In the next columns, estimate the costs: initial filing fees, annual franchise taxes, and registered agent fees. In the final column, list the primary benefits for your specific business (e.g., "Access to Chancery Court," "No state income tax," "Enhanced privacy").

- Consider the "91�Թ��� State" Advantage: Never underestimate the simplicity of incorporating in your home state. If you plan to conduct most of your business locally, forming your entity where you live eliminates the need for foreign qualification and simplifies your state tax filings. For many small businesses, artists, and local service providers, this is often the most practical and cost-effective path.

Ultimately, choosing your state of incorporation is about building a legal foundation that is as ambitious and resilient as your business idea. It's a strategic move that aligns your legal structure with your financial and operational reality. By carefully considering the factors we've outlined, you are empowering yourself to make a confident choice that will serve your company not just at its launch, but for many years of growth to come.

This decision is too crucial to leave to chance. The team at Cordero Law specializes in guiding entrepreneurs, artists, and innovators through the complexities of business formation to ensure you start on solid legal ground. Let us help you translate your vision into a properly structured entity by visiting us at Cordero Law to schedule a consultation.