So, you're ready to draft a partnership agreement. This isn't just about dotting i's and crossing t's; it's about creating a solid blueprint for your business. This document will define everything from contributions and roles to how you'll share profits and what happens if someone decides to leave. It's the one thing that ensures every partner is on the same page from day one.

Why a Handshake Is Not Enough for Your Business

I've seen it a hundred times. Founders are buzzing with excitement, bonded by a shared vision and mutual trust. They think a handshake is enough to seal the deal. While the sentiment is great, this approach is a massive gamble. It leaves the future of your business鈥攁nd often your friendship鈥攙ulnerable to simple misunderstandings that can blow up later.

A partnership agreement isn't about a lack of trust. Far from it. Think of it as the ultimate sign of respect for your business and each other. It鈥檚 the rulebook you write together while everyone is optimistic and thinking clearly, which is exactly what you need to guide you when the inevitable challenges pop up.

The Real-World Risks of Informal Agreements

Without that formal document, every single decision can turn into a painful negotiation. Every disagreement has the potential to become a full-blown crisis.

Let's play this out. Imagine one partner is eager to take out a huge loan to fund a big expansion idea, but the other is much more cautious and risk-averse. Who gets the final say? Or what about a common one: one partner puts in endless hours of "sweat equity" while the other provides the startup cash. How do you value those different contributions if you ever sell the company?

These aren't just abstract what-ifs; they are the exact friction points that tear informal partnerships apart every day. It's a huge reason why nearly 60% of partnerships fail within their first five years, usually because expectations were never clearly defined from the start.

Putting an agreement in place isn't just paperwork. Research shows that partnerships with written agreements slash their internal conflicts by around 30% compared to those operating on a handshake.

A partnership agreement transforms abstract trust into a concrete, actionable plan. It鈥檚 the ultimate act of respect for your business, your partners, and your shared future.

To give you a clearer picture, here's a quick look at the potential disasters you're dodging by getting this done right.

Key Risks of Operating Without a Partnership Agreement

| Risk Area | Potential Consequence | How an Agreement Helps |

|---|---|---|

| Profit & Loss Distribution | Disputes over "fair" shares lead to resentment and legal battles. One partner might feel they're doing more work for the same cut. | Defines exact percentages and the basis for them (e.g., capital, time), preventing arguments later. |

| Decision-Making Authority | A 50/50 split can lead to total gridlock on critical decisions, paralyzing the business. | Establishes voting rights and a clear process for breaking ties or handling major decisions. |

| Partner Exit or Death | The business could be forced to dissolve or the remaining partners might be stuck with an heir they can't work with. | Creates a clear buyout plan (buy-sell agreement), protecting the business and providing a fair exit for all parties. |

| Dispute Resolution | Minor disagreements can escalate into expensive, relationship-destroying lawsuits because there's no agreed-upon process. | Outlines a specific, required process like mediation or arbitration first, saving time, money, and stress. |

As you can see, this isn't just about avoiding the worst-case scenario. It's about building a stronger, more resilient business from the ground up.

Protecting Your Vision and Finances

A well-crafted agreement does so much more than just prevent fights; it actively protects the very thing you're working so hard to build. It lays a stable foundation for growth by clearly spelling out how profits and losses are handled, how key decisions get made, and exactly what the process is if a partner needs or wants to leave.

By taking the time to explore the advantages and disadvantages of a business partnership, you'll immediately see how a formal agreement helps you lean into the pros while shielding you from the cons.

This document is your roadmap. It makes sure everyone's financial interests are protected while keeping you all pointed toward the same long-term vision. Skipping this step isn't a shortcut鈥攊t鈥檚 like leaving the front door of your business wide open. Let's stop thinking of it as a legal chore and start seeing it for what it is: the single most important investment you can make in your company's future.

The Critical Conversations Before You Start Writing

The best partnership agreements aren't born from a template. They鈥檙e the end result of honest, sometimes tough, conversations. Before you even think about legal language or drafting clauses, you and your partners need to get on the same page about the big stuff.

This pre-writing stage is where the real foundation of your business relationship is built. Skipping it and jumping straight into a document is like trying to build a house without a blueprint. You might get the walls up, but you'll quickly find the structure is unstable and nothing connects properly. These talks are your chance to make sure everyone's vision, expectations, and personal commitments are actually aligned.

Of course, this all starts with finding the right people. Before you can have these crucial talks, you need to know who share your drive in the first place.

Aligning on Vision and Values

This sounds like a no-brainer, but it鈥檚 where many partnerships quietly start to crack. You have to agree on more than just "let's make money." What's the real point of this business?

Are you trying to build a lifestyle company that comfortably supports your families? Or are you aiming for hockey-stick growth and a massive exit in five years? One path prioritizes stability and sustainable profits; the other demands high-risk, high-reward decisions. A mismatch here is guaranteed to cause constant friction.

It's time to ask each other the tough questions:

- What does success look like in one year? Five years? Ten? Get specific. Talk about revenue goals, team size, market position, and even what personal fulfillment looks like for each of you.

- What are our non-negotiable company values? This could be a deep commitment to sustainability, fostering a particular type of company culture, or an unwavering obsession with customer service.

- What will our brand's reputation be? Are we the premium, high-end option or the accessible, budget-friendly choice?

The Uncomfortable Money Talk

Let鈥檚 be honest, talking about money can be awkward. But it's absolutely essential. I've seen more partnerships implode over financial ambiguity than almost anything else. You have to get every last detail out in the open before a single dollar is invested.

Your financial discussion really needs to cover two key areas: initial contributions and ongoing compensation. Are you all putting in equal cash? What if someone is contributing valuable equipment, a patent, or even real estate? If so, you must agree on a fair market value for those non-cash assets before you start.

Don鈥檛 just assume everyone is on the same page about sweat equity. Define its value and how it translates to ownership from day one to prevent massive headaches down the road.

This clarity nips future resentment in the bud, especially when one partner feels they've put in more than their ownership stake reflects.

Clarifying Roles and Time Commitment

Another huge friction point is a mismatch in expected effort. It's not uncommon for one partner to be ready to quit their day job and log 80-hour weeks, while another sees the business as a side project that fits into a 10-15 hour weekly window. Both approaches are perfectly valid, but they are completely incompatible if they haven't been discussed.

Get brutally honest about your expectations.

- How many hours a week will each of you realistically commit? Talk about this for the intense launch phase and for the long haul.

- What specific roles and responsibilities will each person own? Move beyond vague titles. Who is ultimately in charge of sales? Marketing? Product? Finance?

- How will you handle it if a partner isn't pulling their weight? It鈥檚 far better to agree on a process for this now, while everyone is still on great terms.

Having these conversations allows you to build a partnership agreement that reflects your actual reality, not some generic ideal. It transforms the document from a legal formality into a true, shared roadmap for your journey together. Get this foundational work done, and the process of actually writing the agreement becomes infinitely smoother.

Getting the Essential Clauses Down on Paper

Once you've had those foundational conversations, it's time to translate that shared vision into the legal backbone of your business. This is where you draft the core clauses that give your partnership agreement its real power and clarity. Think of these as the load-bearing walls of your business structure; get them right, and you've built a solid foundation for whatever comes your way.

This isn't just about filling in a generic template. It's about carefully crafting each section to reflect the specific handshake deals you and your partners have already made. Each clause tackles a different piece of your business puzzle, from what you'll call yourselves to how you'll handle the money.

Formalizing business relationships isn't just a good idea鈥攊t's a global standard. At Investopia 2025, a major event all about fostering partnerships, a staggering 24 partnership agreements and Memoranda of Understanding (MOUs) were signed. This just goes to show that successful collaborations are built on clear, formal agreements. You can get the full rundown on the .

Defining Your Business Identity and Purpose

The first few clauses you'll tackle are straightforward but absolutely vital. They officially name your partnership and nail down exactly what it is you plan to do.

- Partnership Name: This is simple: the legal name your business will operate under.

- Business Purpose: Get specific here. Instead of a vague "sell coffee," a better purpose would be, "to operate a specialty coffee shop, including the sale of brewed coffee, roasted beans, pastries, and branded merchandise." This kind of clarity helps prevent "scope creep," where the business drifts into ventures that not all partners originally signed up for.

This section is also where you'll list details like the business's main address and the official start date of the partnership.

A well-defined purpose clause is your business's North Star. It keeps everyone aligned on the core mission and gives you a solid framework for making future strategic decisions.

Clarifying Capital Contributions and Ownership

This part is a big deal, maybe the biggest. It directly impacts each partner's financial stake and what they get in return. Any fuzziness here is a recipe for serious trouble down the road. You have to meticulously document what each person is putting on the table.

Remember, contributions aren't always cold, hard cash. One partner might put in $50,000, while another contributes $30,000 worth of essential equipment and a client list they've spent years building. The trick is to agree on a fair monetary value for these non-cash assets before anyone signs anything.

Here's what you need to cover:

- Cash Contributions: The easy one. Just state the exact dollar amount each partner is investing.

- Property or Assets: List every piece of equipment, real estate, or other physical asset, along with its agreed-upon value.

- Intellectual Property: This could be a patent, a chunk of software code, or a trademark. Valuing IP can be tricky, but it's crucial to land on a number everyone accepts.

- Sweat Equity: If a partner鈥檚 main contribution is their time and expertise, you have to define how that work translates into ownership over time. This is often done with a vesting schedule.

Once all contributions are valued, you can figure out the ownership percentages. These numbers will dictate everything from who owns what to how profits, losses, and voting power are split.

Structuring How You'll Split Profits and Losses

How is the business going to share its wins and its setbacks? Your agreement needs to spell this out with zero ambiguity. Don't just assume profits will be split according to ownership percentages鈥攖hat鈥檚 not always the case.

There are a few ways to slice this pie:

- Fixed Percentage: This is the most common route. Profits and losses are distributed in direct proportion to each partner's ownership stake. For example, a 60% owner gets 60% of the profits.

- Guaranteed Payments: With this model, a partner might get a fixed, salary-like payment before any leftover profits are distributed. This is a great solution when one partner is handling the bulk of the day-to-day operations.

- Tiered Distribution: You can get creative and structure the agreement so that profit-sharing percentages change after the business hits certain revenue or profit milestones.

If you want to get a better feel for the specific legal wording, checking out a variety of contract clause examples can give you some great insight into how these ideas are formally written down.

Setting Up Partner Salaries and Draws

Finally, you need to define how partners will get paid for their work. A partner's "draw" is essentially an advance on expected profits, letting them pull money from their capital account.

Your agreement should make these points crystal clear:

- Are partners allowed to take draws?

- If they can, how often and how much? Is there a cap per month or quarter?

- Are draws tied to the business's profitability? You might, for instance, agree that no one can take a draw unless the business has a certain amount of cash in the bank.

Putting these rules in writing prevents a world of misunderstanding and ensures the financial health of the business always comes first. By carefully drafting these essential sections, you create a fair and legally sound framework that protects everyone involved and sets your partnership up for success.

Defining Roles and Making Decisions Together

Let鈥檚 be honest: ambiguity is the fastest way to poison a good partnership. I鈥檝e seen it happen time and again. When nobody is quite sure who鈥檚 supposed to do what, or how you鈥檒l make the tough calls, small disagreements have a nasty habit of spiraling into major blow-ups.

This part of your agreement is all about preventing that chaos. Think of it as your partnership鈥檚 playbook. You wouldn't send a football team onto the field without assigning positions and a game plan, right? Same principle applies here. You need to get crystal clear on who's responsible for what and how you'll make decisions together.

Establishing Clear Roles and Responsibilities

First things first, we need to move beyond vague titles like "co-founder." While they sound collaborative, they do little to explain who actually owns specific outcomes. To keep things running smoothly and avoid stepping on each other's toes, it's crucial to lay out each partner's duties. For a deeper dive, exploring is a great next step.

Instead of painting with broad strokes, get granular. A simple but powerful exercise is to list every major function in your business and assign a primary owner to each one.

- Sales & Business Development: Who has the final say on pricing? Who鈥檚 leading client outreach and closing deals?

- Marketing & Brand: Who directs the marketing strategy, runs the social media accounts, and greenlights new campaigns?

- Operations & Finance: Who鈥檚 handling the books, managing inventory, and keeping the day-to-day logistics from falling apart?

- Product & Service Delivery: Who is ultimately in charge of product development, quality control, or making sure clients are happy?

This isn鈥檛 about putting people in boxes; it's about creating accountability. It ensures you aren鈥檛 both accidentally working on the same task while a critical area gets ignored. More importantly, it empowers each partner to take ownership and make decisions within their domain without needing a committee meeting for every little thing.

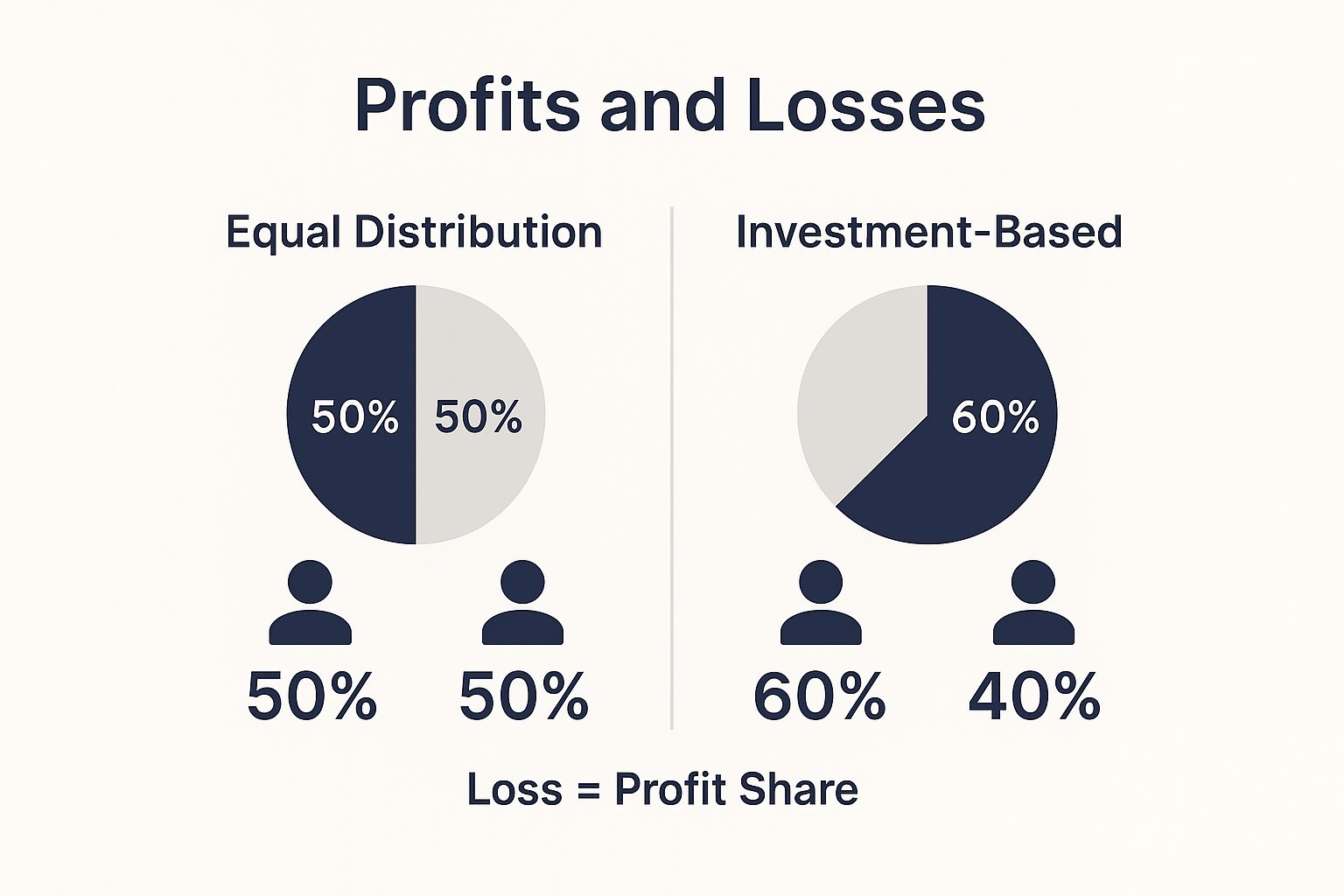

This image really drives home how financial responsibilities, like profit and loss, are often tied directly to these roles and contributions.

As you can see, while a 50/50 split is common, the distribution of profits and losses can鈥攁nd often should鈥攔eflect different levels of investment or responsibility.

Creating a Framework for Decision-Making

Once roles are clear, the next big question is: how will you make decisions that fall outside of one person's defined turf? Your partnership agreement absolutely must outline a clear process. If you leave this to chance, every major choice could end in a stalemate.

There's real data to back this up. Having these guidelines in place is a proven strategy for building a business that lasts.

So, how do you do it? There are several models you can adopt, and your agreement can even specify different approaches for different types of decisions.

Your decision-making clause is your business鈥檚 emergency brake and accelerator, all in one. It stops you from making rash solo moves while empowering you to act quickly when needed.

Let's break down the common approaches you'll want to consider for your agreement.

Choosing the Right Decision-Making Model

Not all decisions are created equal. Deciding to switch coffee suppliers for the office is a world away from deciding to take on $100,000 in debt to open a second location. Your agreement needs to reflect that reality.

Most successful partnerships I've seen use a mix of these frameworks:

- Majority Vote: This is perfect for most day-to-day operational stuff, especially if there are more than two partners. It keeps the business moving without getting bogged down in endless debate.

- Unanimous Consent: This one should be reserved for the big, business-altering decisions. Think selling the company, taking on major debt, or bringing in a new partner. Requiring everyone to agree protects all partners from being dragged into a direction they fundamentally oppose.

- Delegated Authority: This approach is all about trust and expertise. It empowers the partner who knows the most about a certain area to make the final call. For example, the partner in charge of tech might have the final say on software purchases up to a certain dollar amount.

To help you figure out what makes sense for your business, here's a quick look at how these models stack up against each other.

Decision-Making Framework Comparison

| Decision Model | Best For | Potential Pitfall |

|---|---|---|

| Unanimous Consent | Major decisions like selling the business, taking on significant debt, or bringing on a new partner. | Can lead to gridlock if one partner consistently blocks progress on important issues. |

| Majority Vote | Routine operational choices, such as hiring junior staff, approving marketing campaigns, or choosing vendors. | Can create a feeling of disenfranchisement if one partner is consistently in the minority. |

| Delegated Authority | Decisions requiring specialized knowledge, like technology choices or complex financial planning. | Requires a high degree of trust in the designated partner's judgment and expertise. |

By defining these rules of the road upfront, you're not just filling out a legal document. You're proactively removing a massive source of future conflict. This foresight builds a more resilient, collaborative, and ultimately more successful business.

Creating Your Partnership Exit Strategy

It always feels a bit strange鈥攎aybe even pessimistic鈥攖o plan for the end of a partnership right when you're starting out. But I've learned from experience that a well-defined exit strategy is one of the smartest things you can do for your business's long-term health.

This isn't about planning to fail. It's about being realistic and preparing for the inevitable twists and turns that life and business throw your way.

Think of this section as your roadmap for handling the "what ifs." By sorting out how a partner's departure will work now, while everyone is friendly and thinking clearly, you can sidestep a massive crisis later. Trust me, it鈥檚 much better to have these conversations today than to try and figure things out in the middle of a high-stakes, emotional mess.

Planning for a Partner's Voluntary Withdrawal

People's priorities shift. One of your partners might get a dream job offer, decide to move across the country for family, or simply find their passion lies elsewhere. A voluntary withdrawal clause, which is often part of a buy-sell agreement, prepares you for this exact scenario.

This clause is essentially a pre-nup for your business, spelling out the rules of engagement for a friendly departure. You'll want to cover a few key things:

- Notice Period: How much of a heads-up does a departing partner need to give? A 60 or 90-day notice is pretty standard and gives everyone else time to prepare.

- Buyout Obligation: Do the remaining partners have to buy out the departing partner's share, or do they just get the first right of refusal?

- Valuation Method: This is the big one. How will you calculate the fair price of that partner's ownership stake?

Having a pre-agreed valuation formula is the single best way to avoid a bitter dispute over what the business is worth. It removes emotion and guesswork from the equation, ensuring a fair process for everyone.

Addressing Involuntary Exits and Difficult Circumstances

Of course, not all departures are planned and amicable. Your agreement needs to face the tough stuff head-on, like a partner's death, long-term disability, or even the unfortunate need to remove someone for cause. Having a clear, unemotional process baked into your agreement is crucial for navigating these challenges.

For example, what if a partner becomes permanently disabled and can no longer contribute? The agreement should trigger a buyout of their shares, which can often be funded by a disability insurance policy. In the tragic event of a partner's death, a life insurance policy can provide the cash for the remaining partners to buy the deceased's stake from their estate. This is critical鈥攊t prevents heirs from suddenly becoming your new, and perhaps unwilling, business partners.

It鈥檚 also smart to include clauses for removing a partner for specific, serious reasons like fraud, a criminal conviction, or a major breach of their duties. This protects the business and the remaining partners from the fallout of one person's bad actions.

Valuing the Business for a Buyout

So, how do you actually put a number on a partner's share? This is where agreeing on a valuation method ahead of time saves you from future headaches. There are a few common approaches you can bake right into your partnership agreement.

| Valuation Method | How It Works | Best For |

|---|---|---|

| Fixed Price | You all agree on a specific dollar value for the business upfront and promise to review it annually. | Simple partnerships where the business value is stable and relatively easy to pin down. |

| Formula-Based | The value is calculated with a pre-set formula, like a multiple of revenue or earnings (e.g., 3x annual profits). | Businesses with predictable cash flow that want a straightforward, objective calculation. |

| Third-Party Appraisal | You hire an independent, professional appraiser to determine the fair market value when an exit is triggered. | Complex businesses or any situation where you need an unbiased expert opinion to guarantee fairness. |

The right method really depends on your business, but the most important thing is to pick one and commit to it in writing. This prevents a departing partner from demanding an inflated price and the remaining partners from trying to lowball them.

Navigating a Complete Business Dissolution

Finally, what happens if everyone agrees it's time to call it a day? It's not the goal, but a clear dissolution clause is your final layer of protection. This part of the agreement should outline the step-by-step process for winding down the business in an orderly way.

This ensures all partners are on the same page and that every legal and financial loose end gets tied up properly. For a more detailed walkthrough, you can find some great information on the legal steps for dissolving a partnership agreement to help guide you. By planning for every possibility, you build a stronger, more resilient partnership from day one.

Still Have Questions? Let's Clear a Few Things Up

Even after mapping everything out, it's natural to have a few questions rattling around in your head. The nitty-gritty details of partnership agreements often bring up some specific concerns. Let's walk through a few of the most common ones I hear from founders.

Getting these squared away will help you feel confident as you take the final steps to solidify your business partnership.

Do We Really Need a Lawyer for This?

I get it. You see a free template online, and the temptation to save a few bucks is strong. But I have to be blunt here: don't do it. Think of that online template as a one-size-fits-all t-shirt鈥攊t rarely fits anyone well. Your business is unique, and your agreement needs to be tailored to its specific needs, challenges, and goals, not to mention your state's laws.

A good business attorney is more than just a document-drafter; they're a strategist. They鈥檝e seen what can go wrong and will help you anticipate future conflicts you haven't even thought of yet. That upfront legal fee is a small price to pay to avoid a catastrophic (and incredibly expensive) dispute down the line.

An experienced lawyer doesn't just fill in blanks on a form. They ask the tough questions and guide you through the critical conversations that make your agreement strong, clear, and legally enforceable.

What鈥檚 the Difference Between a Partnership Agreement and Bylaws?

This is a classic point of confusion, but the answer is pretty simple. It all comes down to your business's legal structure. While they serve a similar function鈥攕etting the rules of the road鈥攖hey apply to totally different types of companies.

- A Partnership Agreement is for, you guessed it, a partnership. It鈥檚 the foundational document that defines the relationship between the partners.

- Corporate Bylaws are the internal operating rules for a corporation. They govern things like the board of directors, shareholder meetings, and the duties of corporate officers.

Bottom line: If you're a partnership, you need a partnership agreement. If you're a corporation, you need bylaws.

How Often Should We Update Our Agreement?

Your partnership agreement should never be a "set it and forget it" document. Think of it as a living, breathing part of your business that needs to adapt as you grow. I always recommend sitting down with your partners for an annual review to make sure the agreement still reflects how you actually operate.

Beyond that yearly check-in, you need to update it immediately after any major business event.

For instance, you'll want to pull it out and make revisions when:

- A new partner joins the team

- An existing partner exits

- You take on a significant business loan or outside investment

- You pivot your business model or dramatically change your services

Keeping your agreement current is the single best way to make sure it remains a genuinely useful tool that protects everyone as your business evolves.

Navigating the complexities of a partnership agreement can feel overwhelming, but you don't have to do it alone. The team at Cordero Law specializes in helping entrepreneurs and creatives build strong legal foundations for their businesses. Get the expert guidance you need to craft an agreement that protects your vision and your future. Schedule a consultation with Cordero Law today.